North Sea production and revenues rise for the first time in three years

The United Kingdom is the world’s 22nd largest producer of oil and gas. In addition, it produces small amounts of coal, industrial materials such as kaolin and potash, and construction materials. Overall, the extractives sector contributed a gross value-added of almost USD 30 bn to the UK economy in 2016. According to the UK Office for National Statistics, 35,500 people are directly employed in the extractives sector, with many more jobs supported in the industry’s wider supply chain.

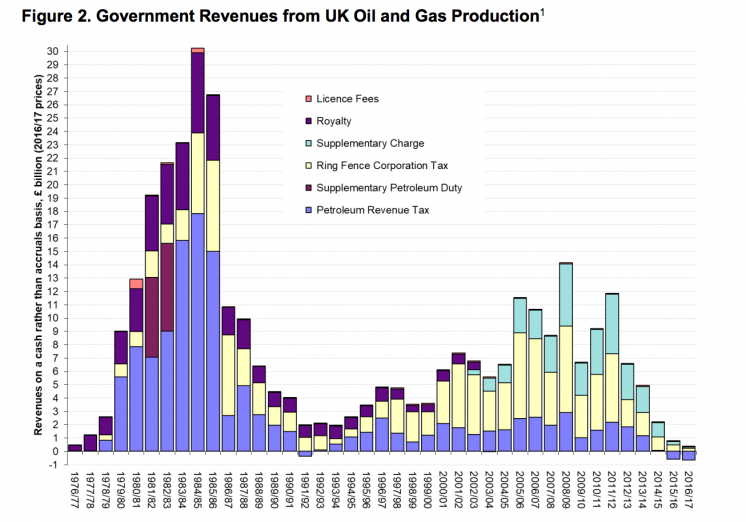

2016 saw higher production and lower expenditure in the sector. However, overall profitability was lower, and there was a net repayment of USD 500m in tax to oil and gas companies. Almost all (over 99%) revenue was related to hydrocarbons, with the rest from mining. Revenues were collected through ring-fence corporation tax (77%), petroleum revenue tax- PRT (19%) and license fees (2%).

The UK oil and gas sector, centred on the North Sea, is one of the most mature in the world. The latest EITI Report gives an update on the policy decisions that have kept the sector viable through the commodity price downturn. These decisions provide other EITI countries with examples of the policy decisions available for mature oil and gas sectors.

Driving investment – a long-term plan to reform the oil and gas fiscal regimes

'Driving investment' is the title of a 2014 UK government report that concluded significant change was needed in order to continue attracting investment, even though the fundamentals of the UK oil and gas regime were sound. In 2016, the Chancellor (the UK’s Finance Minister) announced that the PRT, one of the main taxes on oil and gas companies (there are others, see Figure 2 below), would be zero-rated. Therefore, oil and gas companies have received over USD 1 bn from the UK government in 2015–17 in the form of tax rebates because much PRT had been paid in advance.

To further encourage investment in the North Sea, the government announced almost USD 30m funding for seismic surveys, in order to improve the understanding of under-explored areas. These efforts seem to have paid off, as the most recent license round was described as ‘transformational’ by the UK Oil and Gas Authority (the body responsible for maximising economic recovery from UK oil and gas). 123 licenses were offered to 61 companies to drill eight exploration wells and carry out nine new 3D seismic surveys. Official forecasts anticipate that revenues from oil and gas companies will turn positive in 2017–18 and remain positive until 2022/23.

A global oil and gas transparency champion

The UK government has taken a strong leadership role in the global tax transparency debate, especially in the extractives sector. It has made commitments on commodity trading transparency, written project-by-project reporting for the sector into law, and set up a public People of Significant Control (PSC) register in 2016. Whilst it is much admired, a recent study suggested that 13% of the entries in the PSC register did not conform to the requirements. In April, the UK Parliament voted to require its overseas territories, including the British Virgin Islands and the Cayman Islands, to establish public beneficial ownership registers if they have not done so by the end of 2020.

EITI identifying the challenges of EU Disclosure requirements

The UK EITI is due to begin a study to assess the usability and comparability of the publication of company payments under the EU Transparency and Accountability Directive. If the data submitted under the Directive are consistent, then they could be used as a lighter and more timely mechanism for collecting company data on payments to government – a more systematic disclosure mechanism. However, on the company side, there are challenges around ring-fencing extractive payments, currencies and time periods. This process should help the government provide stronger guidance on submitting the data.

The UK will undergo its first EITI Validation on July 1.

Related content