What’s next for the extractive sector in Norway?

Using transparency to inform policymaking as Norway balances its petroleum wealth with energy transition commitments

The past years have been a critical juncture for Norway’s extractive sector. The country has seen record-high revenues in 2021 from oil and gas. Significant demand and high commodity prices, particularly for gas, resulted in strong export performance to European markets. Open data, innovation and energy transition are high on the agenda.

These trends were front and centre at the Norwegian Continental Shelf Update earlier this week. The event, hosted by the Norwegian Petroleum Directorate (NPD), gathered Norwegian stakeholders from government, civil society and industry to present the recent developments and outlook for the country’s petroleum sector, and to disseminate its data reporting under the EITI Standard.

Management, analysis and interpretation of data is a key role of the NPD, which this year celebrated 50 years in pursuit of responsible management of oil and gas resources produced on the Norwegian continental shelf. Transparency and data are especially important to inform policymaking as Norway seeks to balance its petroleum wealth with energy transition commitments.

Energy transition

According to Ingrid Sølvberg, Director General of the NPD, Norway increased its oil and gas outputs in the past two years, producing 642 million barrels of oil and 113 billion standard cubic meters of gas in 2021. Yet the future of Norway’s petroleum sector has been a matter of public interest, prompting debates on whether to continue licensing rounds and the management of its USD 1.4 trillion oil fund.

Norway is taking several measures to reduce emissions from oil and gas production and adapt business models in response to a carbon-constrained world.

Carbon capture and storage

Development of carbon capture and storage (CCS) technology is a focus for Norwegian research and industrial innovation. The government is investing in a full-scale CCS programme that integrates carbon capture from both petroleum and industrial sources with transport by ship to offshore underground storage on the Norwegian continental shelf. The Longship project will achieve 1.5 million tonnes of CO2 storage per year starting from 2024.

Decoupling emissions and production

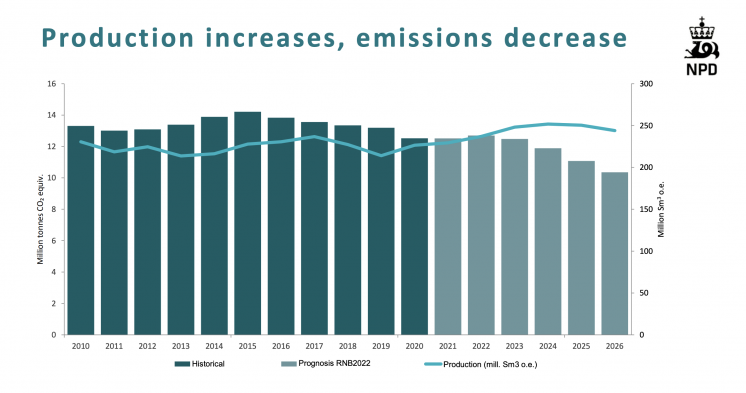

NPD data shows progress on reducing CO2 emissions from oil and gas production. The NPD explained that further reductions are expected from policies that will require electrification of offshore production. This will reduce emissions by switching from gas power to hydropower.

Chart: The Shelf 2021 (Norwegian Petroleum Directorate). The above graph plots the oil production trend (light blue line) against past and projected emissions (dark blue bars).

Hydrogen

The government has set targets for blue and green hydrogen, and plans to develop the subsector through parallel production, distribution and use of hydrogen. It also intends to expand its participation in the sector by establishing a state-owned hydrogen company. The government has identified policy instruments that will be central in the development of hydrogen such as the CO2 tax, the availability of long-term capital and the use of public procurement.

Critical minerals

Norway is rich in mineral deposits that will be important for the energy transition, such as lithium, cobalt, copper and zinc. The government plans to increase the mapping of mineral resources both onshore and offshore with particular emphasis on mineral areas that can play a strategic role in the green economy. In 2021, the Ministry of Petroleum and Energy launched an opening process for mineral extraction that includes a programme of impact assessment.

EITI implementation in Norway

In light of Norway’s high level of systematic disclosure of data, the country implements the EITI Standard under an adapted implementation model, as approved by the EITI Board in 2017. As such, Norway publishes information about its oil and gas sector primarily through its online portal rather than a dedicated annual EITI Report.

Lars Erik Aamodt, Director General at the Ministry of Petroleum and Energy, spoke about the work underway to prepare for Norway’s next EITI Validation scheduled to begin in October this year. While Norway achieved satisfactory progress during its Validation in 2018, it made inadequate progress in meeting the EITI’s requirement on beneficial ownership disclosure following a partial Validation last year. Although the Norwegian legislative framework is complete and the company reporting requirement rolled out, Norway has yet to implement an open, publicly accessible register of the legal and beneficial owners of all companies holding or applying for licenses and contracts in the extractive industries. Progress will be reviewed during the next Validation.

Photo: Øyvind Gravås and Even Kleppa / © Equinor