Summary

In addition to taxes levied by central, regional and local governments, extractive companies often make social and environmental contributions in the areas where they operate. These contributions can be made to central, regional or local governments, communities, non-governmental organisations or other third parties.

Social and environmental payments – either in-kind or cash – are a form of contribution from companies with the aim of supporting social development or to account for potential environmental impact. In some cases, these social or environmental expenditures are based on legal or contractual obligations. In other cases, companies make voluntary social or environmental contributions.

Communities do not always know how much companies are obliged to contribute according to their contracts. Misunderstanding about what constitutes a mandatory and voluntary social and environmental expenditure and lack of access to the contractual terms can make public oversight challenging. It is thus important to be transparent about the expectations and the actual contributions made to provide a more complete picture for all stakeholders involved.

Government stakeholders and citizens have a particular interest in ensuring that the social and environmental expenditures are effective and reach the intended beneficiaries. Companies also have an interest in demonstrating their positive contribution beyond fiscal payments, managing community expectations and ensuring that the expenditures they make and the projects they are directed towards are well managed and executed.

Requirement 6.1 of the EITI Standard requires that significant mandatory social expenditures and environmental payments are disclosed and reconciled where possible. This note provides step-by-step guidance to multi-stakeholder groups (MSGs) on how to report on social and environmental expenditures, offers examples from implementing countries and outlines opportunities to strengthen the dissemination and use of data.

-

What social and environmental expenditures are made by companies and who are the recipients and beneficiaries?

-

How do actual expenditures by companies compare with their contractual obligations?

-

Do the expenditures reach intended beneficiaries including women and marginalised groups?

-

How significant and effective are environmental payments?

-

How are environmental rehabilitation funds managed and monitored?

Overview of steps

|

Steps |

key considerations |

examples |

|---|---|---|

|

Step 1: |

|

|

|

Step 2: |

|

|

|

Step 3: |

|

|

|

Step 4: |

|

|

How to implement Requirement 6.1

Step 1: Identify social or environmental expenditures by companies

MSGs should identify whether companies make social or environmental expenditures, including whether these are mandatory or discretionary. In order to identify whether companies provide social expenditures, the MSG is advised to consult:

- Extractive companies and industry associations with a view to understanding the type and nature of any social or environmental expenditures, and whether expenditures identified are discretionary or part of the companies’ legal and/or contractual obligations.

- The legal and regulatory framework governing the extractive sector to identify whether social expenditures are mandated by law. Where mandated by law, the MSG may wish to include a reference to the relevant legal provisions in EITI disclosures.

- Agreements and contracts, where available, in order to understand whether social and environmental expenditures are mandatory or voluntary.

It is recommended that the findings from this work are documented in MSG meeting minutes, scoping studies or in EITI reporting.

Types of social and environmental expenditures include:

- Social payments versus expenditures. Social payments and expenditures can take multiple forms, and may involve cash payments such as donations, grants or other types of cash transfers, the transfer of assets such as the construction of roads or schools, or the provision of services like training and health care. In some cases, these social expenditures and payments are based on legal or contractual obligations. In other cases, companies make voluntary social contributions.

While terms “social expenditures” and “social payments” are often used interchangeably, the general understanding is that social payments typically refer to payments made directly by the company to a government entity, while social expenditures can also be used to refer to transfers made to third parties (e.g. a construction firm to build infrastructure or a school). Where these are mandated by law or the terms of the contract governing their extractive investment, the EITI Standard requires that material expenditures are disclosed and where possible reconciled (EITI Requirement 6.1.a). Disclosures of voluntary social expenditures are encouraged (Requirement 6.1.d).

- Environmental payments. Environmental payments are typically made by companies to the government to compensate for or mitigate potential environmental impact by oil, gas and mining operations. Such payments can be mandated by law, regulation or contract and may consist of fees related to environmental licenses, specific taxes or payments related to emissions, pollution or water and energy use, waste fees, and contributions to environmental protection agencies or funds. Where these payments to the government are material, the EITI Standard requires that these are disclosed and reconciled. This provision is aligned with EITI Requirement 4.1. on comprehensive disclosures of taxes and revenues. These payments are not always generally considered material, although they are often of interest to citizens and local communities. Environmental expenditures made to third parties that do not represent a government entity (e.g. a service provider performing activities required by environmental work programmes) are typically not considered within the scope of the requirement.

Additional sources of definitions of social and environmental expenditures include IMF’s Technical Guidance Note on Government Finance Statistics, which categorises the following:

- Mandatory social payments as “Compulsory transfers to government (infrastructure and other), 1415E4”

- Voluntary social payments as “Voluntary transfers to government (donations), 144E1”

- Environmental payments as “Emission and pollution taxes, 114522E”

In some cases, EITI Requirement 6.1 may apply beyond these categories to also include social expenditures made to non-governmental entities.

The MSGs might wish to consider reviewing the definitions of social and environmental payments provided by the IMF’s Technical Guidance Note on Government Finance Statistics, noting that the scope of Requirement 6.1 extends to social expenditures made to non-governmental entities.

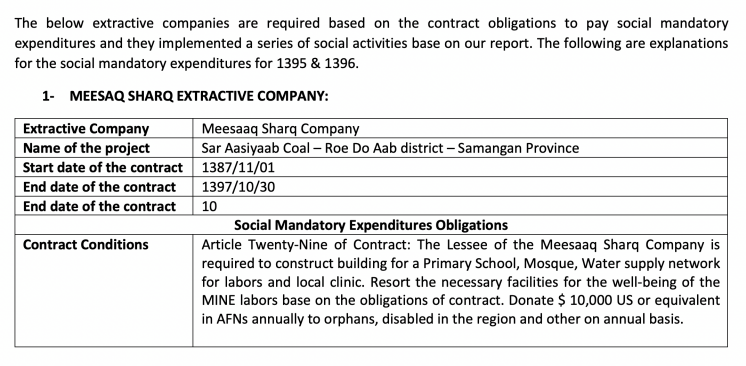

Afghanistan:Social expenditure mandated by contract

Article 31 of the Afghanistan - Qara Zaghan Gold Project contract states that “during the first two years of [the] contract [the company] shall spend a minimum of US$ 50,000 for implementation of social programmes as per the Social Development Plan.”

Guinea: Social expenditure mandated by law

Article 130 Development of the Local Community of Guinea’s Mining Code (2011 amended) states that:

“A holder of a Mining Operation Title must enter into a Local Development Agreement (LDA) with the Local Community residing on or in the immediate vicinity of its Mining Operation Title. The terms for drafting these agreements are set out in a joint order of the Minister in charge of Mines and the Minister in charge of Decentralization.

The purpose of the Local Development Agreement is to establish conditions that are conducive to the efficient and transparent management of the Contribution to Local Development paid by the holder of the Mining Operation Permit, and to strengthen the capacities of the Local Community in the planning and implementation of the community development programme.

The Local Development Agreement must include among other things, provisions for training the Local Community and, more generally, Guineans, environmental protection and health measures for the Local Community, and processes for the development of social projects.”“

Ukraine: Social expenditure mandated by law

Section VIII of Ukraine’s Tax Code (2010) requires companies operating in the country with activities that result in “emissions of contaminants by stationary sources into the atmospheric air”, “the discharge of contaminants directly into the water pools”, “the placement of the waste in the specifically designated places or objects” and “generation of radioactive waste” to pay environmental tax.

Step 2: Identify existing information available on social and environmental expenditures and their significance

Where the MSG has determined that extractive companies make i) mandatory or ii) discretionary social and environmental expenditures, the MSG should first identify the existing government and company disclosures of information on such expenditures. These could include annual reports, websites or data portals managed by the ministry overseeing the industry or sustainability reports by companiesHideSome companies publish sustainability or corporate social responsibility reports in accordance with Global Reporting Initiative (GRI) Standards. Among the environmental-related aspects recommended to be reported under the GRI framework are: energy consumption, use of water, effluents and waste, emissions, biodiversity impact, compliance with environmental laws and regulations, and number of environmental grievances filed. MSGs might also wish to consult the GRI sustainability disclosure database..

Second, the MSG should agree which payments and revenues are material and need to be disclosed in accordance with the general approach set out in Requirement 4.1.b on selecting appropriate materiality thresholds. When considering the threshold for social and environmental expenditures, the MSG may wish to take into account the importance of these revenue streams for stakeholders and local communities.

In some cases, the data needed to make this assessment will already be publicly available from companies, government authorities or other sources. In other cases, it may only be possible to estimate the size of the payments through consultations with stakeholders. While the absolute value of social and environmental expenditures may be insignificant in comparison with taxes and royalties, the impact on small local economies and social and institutional arrangements may still be considerable.

In accordance with Requirement 6.1, where the MSG determines that mandatory social expenditures or environmental payments to the government are material, the implementing countries must disclose and, where possible, reconcile these transactions (see Step 3). If the MSG concludes that these flows are immaterial, the basis for this assessment should be documented. In such circumstances, it may be useful to provide a summary in EITI disclosures.

Where the MSG determines that discretionary social and environmental expenditures or transfers to government entities are material, the MSG is encouraged to cover these flows in EITI reporting (Requirement 6.1.d).

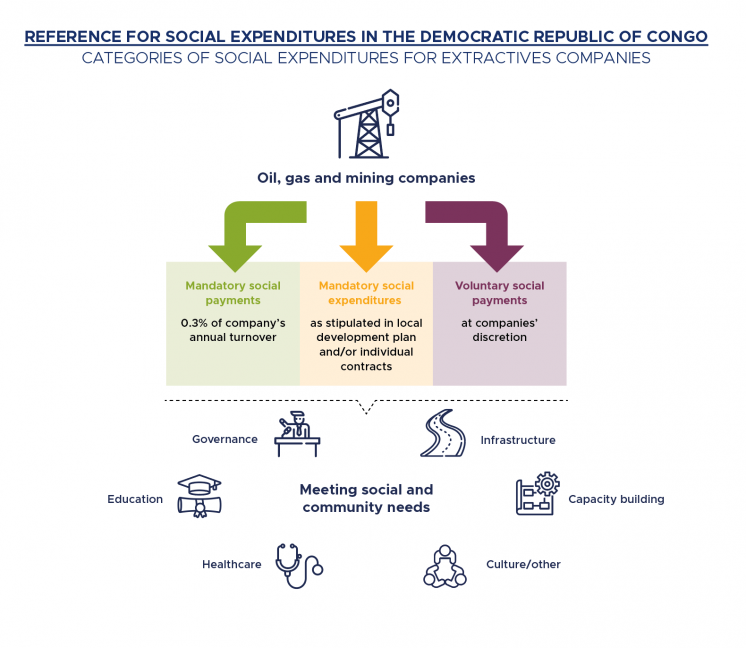

Democratic Republic of the Congo: Disclosure of mandatory social expenditures

Extractives companies in the Democratic Republic of the Congo are required to disclose mandatory social expenditures, and many also disclose voluntary social payments. The absence of a consensus definition of what constitutes a social expenditure meant that many companies failed to disclose required information, while others were accused of inflating the value of such payments or not addressing communities’ needs. The 2018 Mining Code introduced provisions taking these concerns into account.

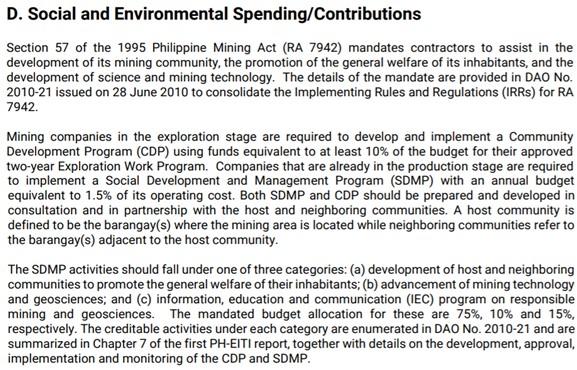

The Philippines: Social and environmental spending and contributions

Philippines’ 2017 EITI Report describes the existing social and environmental expenditures, including requirements to funds community assistance projects, mandatory expenditures as part of Environmental Work Programmes and mandated transfers to Mine Rehabilitation Funds. The report also describes voluntary expenditures made by companies as part of their Corporate Social Responsibility (CSR) efforts.

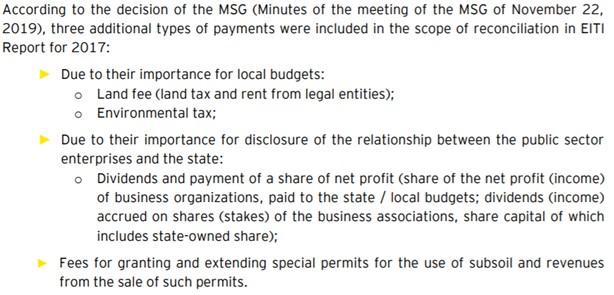

Ukraine: Disclosure of environmental tax

Ukraine EITI has been disclosing and reconciling the environmental tax through EITI reporting since 2013. While this revenue stream represents a small share of total revenues, the MSG agreed to include it in the scope of EITI reporting due to its significance for local communities. Moreover, civil society is actively engaging in the environmental discussion in Ukraine, including on analysing the environmental tax and providing recommendations on how it can better benefit citizens.

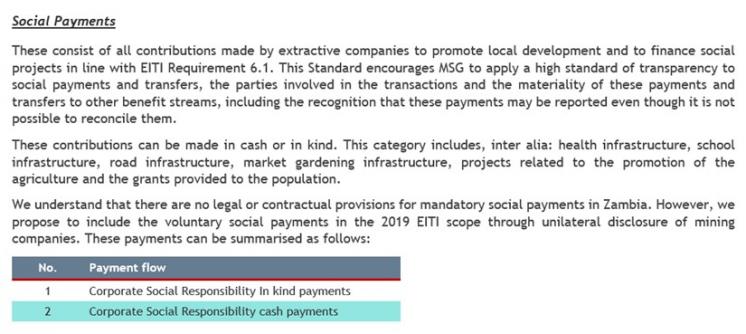

Zambia: Discretionary social expenditures

Zambia’s 2019 scoping study found that there were no mandatory social expenditures in Zambia, while it identified discretionary social expenditures. The MSG agreed to include these in the scope of EITI disclosures and request data on such expenditures from companies. This was documented in the 2019 EITI Report.

Step 3: Data collection and disclosure of social and environmental expenditures

Where the MSG has established that social and environmental expenditures or transfers to government entities are material, additional work may be needed to design appropriate reporting templates and agree procedures for disclosure and data assurances. In order to agree an appropriate reporting procedure, the MSG is advised to review:

- The nature of the social and environmental expenditures, including whether the social expenditure is provided in-kind (for example through access to services or infrastructure), through financial transactions, or a combination of these. In accordance with Requirement 6.1.a, where mandatory social expenditures are provided in-kind, it is required that the nature and the deemed value of the in-kind transaction are disclosed.

- The parties involved in the transaction (i.e., the provider and the recipient of the social or environmental expenditure), which in addition to the extractive company, may include a government entity, or a third-party recipient such as a charitable organisation or other types of associations. The beneficiary of the social expenditure is the recipient of the benefit, i.e., the person or body who owns or controls or uses the asset or service. In accordance with Requirement 6.1a, “where the beneficiary of the mandated social expenditure is a third party, i.e., not a government agency, it is required that the name and function of the beneficiary be disclosed”.

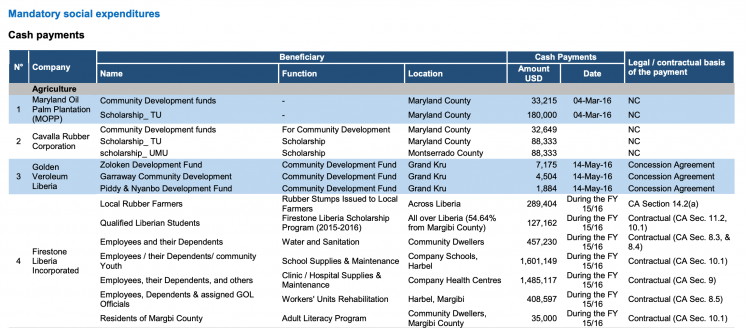

Where feasible, the MSG could consider disclosing the data in a way that addresses information needs of different genders and subgroups of citizens This could be done by disclosing detailed and disaggregated data on beneficiaries, shedding light on whether women, youth or subgroups of citizens are amongst the beneficiaries of such expenditures (e.g. scholarships and trainings, as reported in Liberia). Similarly, gender-sensitive data can help track the extent to which these are allocated to priorities identified by women, which may include staffing of existing facilities for education and health services, as well as environmental remediation. It can also highlight whether women and subgroups of citizens have been consulted in identifying priorities for such expenditures, and whether they are included in follow-up and monitoring.

Depending on the nature of the social and environmental expenditure and the parties involved in the transaction, the MSG needs to determine whether the transactions can be reconciled, or whether it is more appropriate that the company making the payment and/or government entity receiving the benefits unilaterally disclose the nature and the value of the transaction.

Where the social or environmental expenditure is a financial transaction between an extractive company and a government entity, or a community development or environmental rehabilitation fund, reconciliation will in most cases be feasible. However, where the social or environmental expenditure is provided in-kind or the payment is made to a contractor for the implementation of a project or service or to an NGO, reconciliation may well be challenging. In such cases the reporting template should be designed so that the extractive company describes the nature of the social or environmental contribution provided and the deemed monetary value at the time that the expenditure was made. Similarly, where the beneficiary is not a government agency but a third party, the reporting template should enable the name and function of the beneficiary to be disclosed.

The MSG is advised to explain and document the agreed approach for reporting on social and environmental expenditures. The MSG may also wish to task its technical team, a relevant government entity, or Independent Administrator with proposing templates for reporting on social and environmental expenditures.

|

Data points to be disclosed |

Additional disclosures MSGs could consider |

|

|

Afghanistan: Disclosure of mandatory social expenditures

Afghanistan’s Ministry of Mines and Petroleum has published details on mandatory social expenditures on its website, including a comprehensive review of contractual requirements to undertake social expenditures in all material companies’ operating contracts. The review highlighted mandatory social expenditure requirements in the contracts of eight of the 14 material companies. The review distinguished mandatory and voluntary social expenditures. Information on the values, disaggregation of cash and in-kind contributions, and non-government beneficiaries were provided for some, but not all expenditures.

Liberia: Cash and in-kind social expenditures

Liberia’s 2015-2016 EITI Report breaks down mandatory and discretionary cash and in-kind social expenditures, with indication of the amount, beneficiary and date of transfer. The data includes information on the legal/contractual basis for the expenditures.

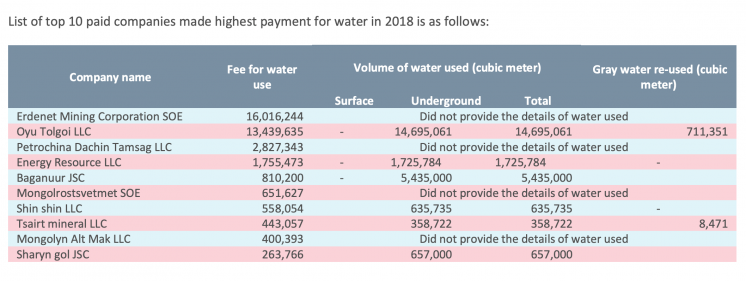

Mongolia: Water use and related payments

Mongolia’s 2018 EITI Report provides information reported by companies on water use and related payments, comparing the contracted and actual use of water. The report also provides information on waste management and air pollution.

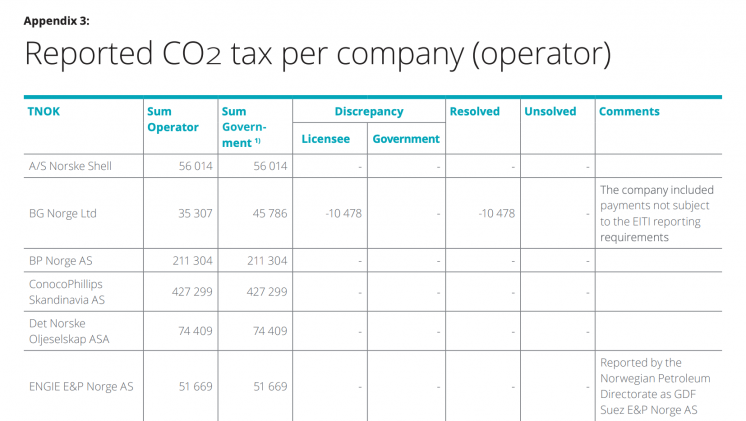

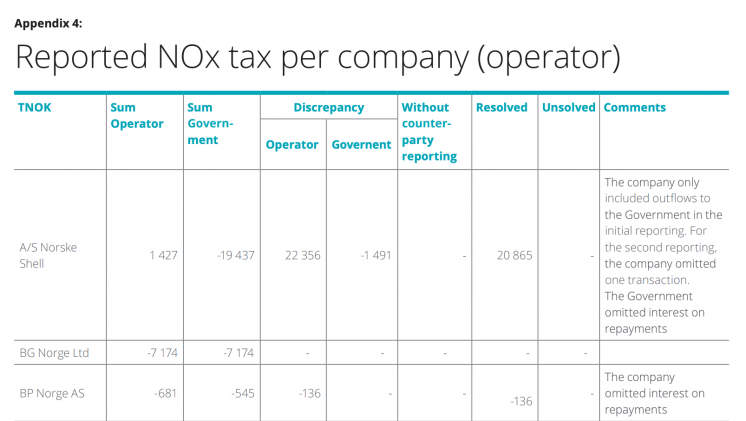

Norway: C02 and NOx tax

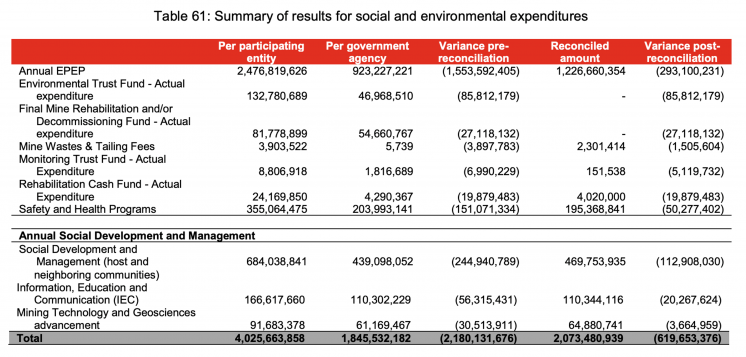

The Philippines: Social and environmental expenditures

Philippines’ 2017 EITI Report includes a summary of the social and environmental expenditures.

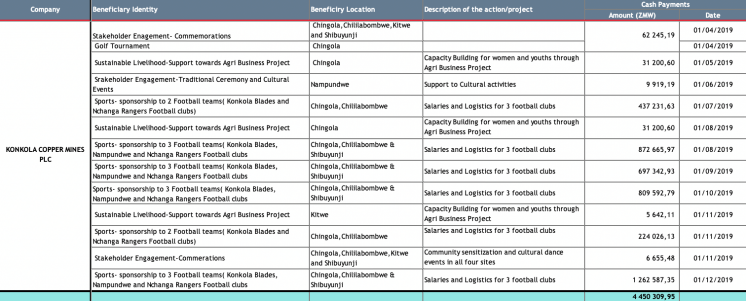

Zambia: Beneficiaries of voluntary social expenditures

Zambia’s 2019 EITI Report provides details on the value, nature and beneficiaries of voluntary expenditures by companies. This includes beneficiaries who represents women, youth and local communities.

Step 4: Review and analysis of social and environmental expenditures

Prior to or after publishing information on social and environmental expenditures, the MSG could review and analyse the information identified and collected, consider findings from the report and agree recommendations for the MSGHideFurther guidance on developing recommendations from EITI reporting available here. or other stakeholders to address. If the MSG has agreed work plan objectives related to social development, environmental impact or contributions to local communities, the MSG could consider how the disclosures could be used to help meet the objectives.

Examples of such recommendations from EITI disclosures includes:

- A recommendation for the government to consider establishing a mechanism to monitor extractive companies’ compliance with social and environmental obligations, and to trace the execution of social expenditures with a view to maximise the impact on local populations (see, for example, Cameroon’s 2013 EITI Report, p. 75).

- A recommendation for the government to review the audited accounts of the Environment Protection Fund and to engage the Fund Board to ensure greater transparency in the management of the fund (see, for example, Zambia’s 2016 EITI Report, p. 79).

Questions the MSG could consider include:

- How do the provisions related to social and environmental expenditures compare to actual practice?

- How does the government monitor and account for mandatory and discretionary social and environmental expenditures?

- How can the information be presented to help stakeholders understand the nature of social and environmental expenditures and who the recipients/beneficiaries are?

Disclosures related to social and environmental expenditures have been used by stakeholders in EITI implementing countries to inform debates on how expenditures are managed and used, their efficiency and how to make sure expenditures contribute to positive social impact and environmental protection.

Kazakhstan: From disclosures to accountable spending

Oil, gas and mining companies operating in Kazakhstan have to make mandatory social investments in the regions where they operate. The investments are large, amounting to almost USD 150 million annually. By disclosing the amounts paid, the purpose and beneficiaries, EITI Reports have revealed lack of accountability in spending decisions at local level. As a result, a centralised payment and disbursement mechanism was introduced in 2014, including budget classification codes, limiting the opportunity for discretionary spending.

Zambia: Environmental Protection Fund

In Zambia, concerns have been raised by stakeholders about mining company payments related to rehabilitation and the management of the Environmental Protection Fund (EPF). The fund “lodges” contributions as deposits to be spent by the government in case of need for rehabilitation of mining areas where the mining licence holder fails to do so. Companies are required under the EITI to report their payments to the EPF.

Audits conducted on the EPF by the government found that the fund was not working effectively. The audits undertaken to ascertain the extent of the environmental liability caused by each individual mining firm concluded that mining companies were not complying with the EPF’s regulations and the majority were not paying the stipulated contributions. Zambia EITI Reports have also highlighted challenges in the oversight of the fund, and the latest 2017 report recommends improving the implementation of the EPF by setting up a clear investment policy, appointing a fund manager and ensuring that all mining companies comply with the EPF requirements. These recommendations are being followed up by the Ministry of Mines and Mineral Development.

Further resources

Related content