Summary

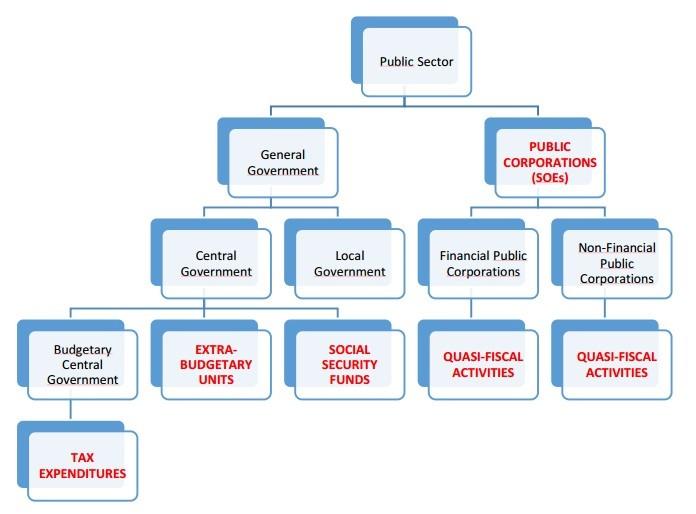

Quasi-fiscal expenditures (QFEs) or off-budget expenditures can have a significant impact on the local and national economy, and on the government’s fiscal position. In many countries, state-owned enterprises (SOEs) undertake QFEs on behalf of the state such as payments for social services, public infrastructure, fuel subsidies and national debt servicing, which are not recorded on the national budget. The IMF Manual on Fiscal Transparency highlights the importance of identifying and quantifying quasi-fiscal activities.

Common governance challenges include opaque public spending (e.g. on defence), greater risks of fraud, lack of auditing of expenditures undertaken by quasi-public entitiesHideA quasi-government entity is one supported by the government but managed privately. See Merriam-Webster definition, and expenditures undertaken at a loss or below the usual rate of profit. QFEs are often considered sub-optimal compared to fiscal expenditures reported in the national budget, which usually has parliamentary oversight.

As Transparency International notes in its Public Financial Management guide, “off-budget activities pose problems in reporting and consolidating fiscal data and constitute a major transparency challenge. In terms of accountability, they are often submitted to less stringent requirements for reporting and public oversight.” This can be particularly acute in the extractive industries, where there are often several government and state-owned entities involved in managing significant amounts of revenues.

One of the key aspects of the EITI Standard is the traceability of extractive revenues that are not recorded in the state’s national budget. This note provides guidance to multi-stakeholder groups (MSGs) on how to address these issues as part of EITI implementation and offers examples of how implementing countries have reported on QFEs in the extractive industries.

- Is the government undertaking expenditures outside the national budget, funded by extractive revenues?

- Is there sufficient public oversight of off-budget expenditures, and how do they risk affecting the government’s fiscal position?

- Is the state providing off-budget subsidies for fossil fuel consumption through its SOEs? Are such subsidies accounted for?

- What reforms can the government undertake to limit governance risks linked to quasi-fiscal expenditures undertaken by SOEs?

Overview of steps

|

steps |

key considerations |

examples |

|---|---|---|

|

Step 1: |

|

|

|

Step 2: |

|

|

|

Step 3: |

|

|

|

Step 4: |

|

|

|

Step 5: |

|

|

How to implement requirement 6.2

The EITI International Secretariat recommends the following step-by-step approach to MSGs for reporting on quasi-fiscal expenditures (QFEs) in the extractive industries. It is recommended that the findings from each step are documented in MSG minutes, scoping studies and as part of EITI reporting itself.

In line with the default expectation that EITI implementing countries systematically disclose data required by the EITI StandardHideEITI Board Decision 2018-08/BM-39, February 2018, the MSG should work with SOEs and government entities to ensure publication of information listed under Requirement 6.2 by the custodian entities. The EITI reporting process should review publicly available information, address any gaps in the existing data and analyse the data to contribute to improving the transparency and management of the sector around QFEs.

Step 1: Agree a definition of quasi-fiscal expenditures (QFEs)

The MSG should first agree a definition of QFEs in line with the minimum required by the EITI Standard. Requirement 6.2 states that QFEs include “arrangements whereby SOEs undertake public social expenditure such as payments for social services, public infrastructure, fuel subsidies and national debt servicing, etc. outside of the national budgetary process.” It should clearly distinguish quasi-fiscal expenditures from social expenditures that are not undertaken on behalf of the state and infrastructure provisions undertaken in full or partial exchange for oil, gas or mining exploration or production concessions or physical delivery of such commodities (see Requirements 6.1 and 4.3 of the EITI Standard). In categorising an expenditure as quasi-fiscal, the MSG is encouraged to explain its rationale for considering an expenditure as being undertaken on behalf of the state.

The MSG may wish to consider the definition of quasi-fiscal activities in the IMF’s 2007 Fiscal Transparency Manual. The manual includes a typology of quasi-fiscal activities that MSGs may find useful and indicates how governments should cover quasi-fiscal activities in their budget documents. According to the manual, budget documentation should include statements on the purpose, duration and intended beneficiaries of each quasi-fiscal activity, based on information provided by those agencies that undertake such activities. Public corporations should include in their reports specific information on, for example, noncommercial services that the government requires them to provide or lending to other government-owned agenciesHideThe International Budget Partnership has also prepared a useful guide on quasi-fiscal activities. International Budget Partnership (2013) Guide to Transparency in Public Finances Looking Beyond the Core Budget: 3. Quasi-fiscal Activities. Where budget reports and SOE annual reports or financial statements are publicly accessible, these may be useful starting points for MSGs to understand the type of quasi-fiscal activities related to the extractive industries or revenues collected from the sector.

|

Types of quasi-fiscal activities |

Examples |

|

Operations related to the financial system |

|

|

Operations related to the exchange and trade systems |

|

|

Operations related to the commercial enterprise sector |

|

Step 2: Identify all expenditures from extractives revenues that are not recorded in the national budget

With reference to the definition of QFEs established in Step 1, the MSG should identify expenditures funded by extractives revenues not recorded in the national budget. The MSG should first undertake a comprehensive review of all extractive industry revenues that are collected by government or quasi-government entitiesHideIMF (updated March 2017), Government Finance Statistics Manual 2014, particularly SOEs. Then, it should review the detail of expenditures funded by extractive revenues that are not recorded in the national budget. Useful documents to review include budget documents and SOEs reports, such as annual reports and financial statements. In the absence of a clear categorisation of a revenue flow as off-budget, the MSG is encouraged to include the revenue flow in the scope of its review of potential quasi-fiscal expenditures.

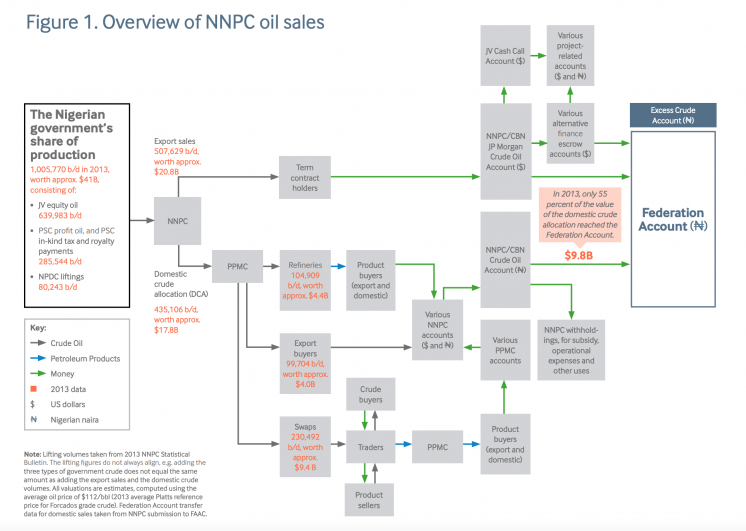

Nigeria: SOE deductions from government’s share of production

Below, the retention of a share of domestic (Naira) crude oil allocations account to cover the share of the subsidy paid by NNPC (Nigerian National Petroleum Corporation) without being recorded in the national budget.

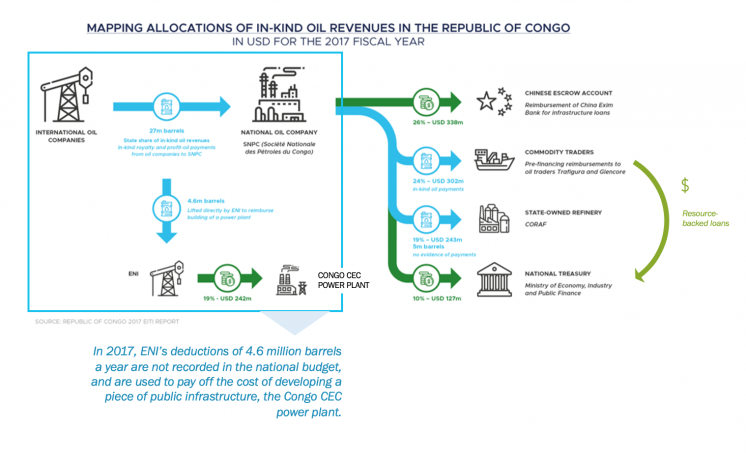

Republic of Congo: Allocation of in.kind oil revenues

In recent years, SNPC (Société nationale des pétroles du Congo) has withheld a share of the proceeds from the sale of the state’s in-kind revenues to pay off infrastructure loans without compensation from the national budget.

Step 3: Identify specific quasi-fiscal activities carried out using extractives revenues not recorded in the national budget

The MSG should categorise off-budget expenditures using extractive revenues as quasi fiscal and distinguish from other types of social expenditures (e.g. mandatory or voluntary social expenditures). Social expenditures that are not undertaken on behalf of the state are covered under Requirements 6.1 of the EITI Standard. Infrastructure provisions undertaken in full or partial exchange for oil, gas or mining exploration or production concessions or physical delivery of such commodities are covered under Requirement 4.3 of the EITI Standard. The MSG should review the detail of expenditures funded by extractives revenues collected and retained by government-related entities such as SOEs. The categorisation should be consistent with the definition agreed under Step 1. The MSG might wish to consider whether the expenditure is a type of activity that would normally be expected to be undertaken by the government.

The MSG is encouraged to consult with locally-based experts on the issue of quasi-fiscal expenditures, including representatives from the IMF, the Ministry responsible for the state budget, economic think tanks, public accountants, academics, etc. The MSG should document its discussions on the categorisation of QFEs in EITI reporting, including a summary of its approach to categorising specific expenditures as quasi-fiscal through EITI reporting. In categorising an expenditure as quasi-fiscal, the MSG is encouraged to explain its rationale for considering an expenditure as being undertaken on behalf of the state.

Examples of public or quasi-fiscal missions assigned to SOEs are also available in the Natural Resource Governance Institute’s ‘Guide to Extractive Sector State-Owned Enterprise Disclosures’:

|

Types of quasi-fiscal activities |

Examples |

|

Regulatory activities within the extractive sector |

|

|

Activities outside the extractive sector |

|

Source: NRGI (2018), ‘Guide to Extractive Sector State-Owned Enterprise Disclosures’.

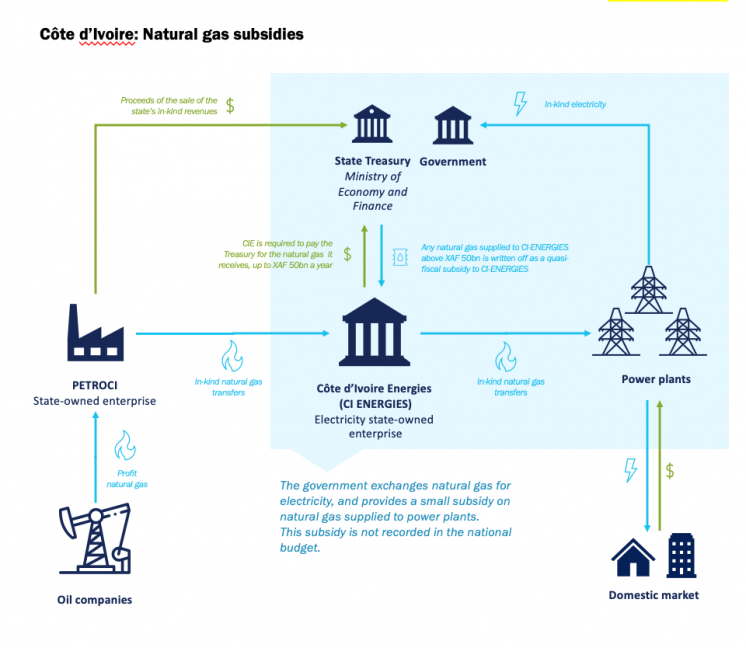

Côte d’Ivoire: Natural gas subsidies

The government subsidises natural gas sales to domestic power producers for expenditures above XAF 50bn, without this being recorded in the national budget. The subsidies are drawn from the state’s in-kind “profit gas” under PSCs, which are processed domestically for electricity generation.

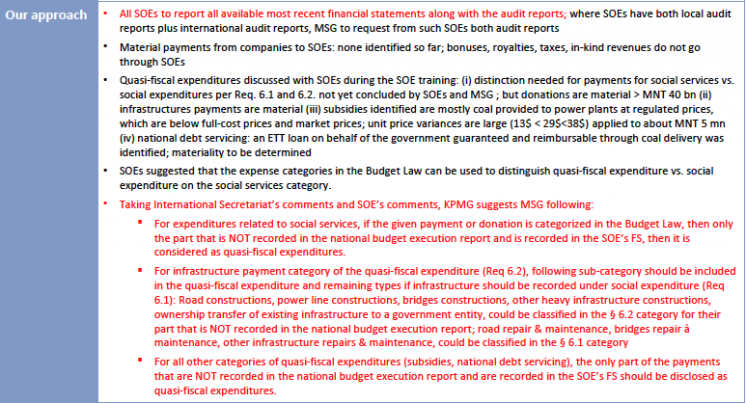

Mongolia: Reporting quasi-fiscal expenditures

The 2016 inception report proposes a methodology for reporting quasi-fiscal expenditures, proposed by the IA for the MSG’s approval.

Step 4: Design a reporting framework for full disclosure of quasi-fiscal expenditures

The MSG should review the state of systematic disclosures of quasi-fiscal expenditures funded by extractives revenues. Often, countries under support programmes from international institutions like the IMF are required to bring their quasi-fiscal expenditures and contingent liabilities on-balance sheet, for these to be recorded in the national budget overseen by Parliament.

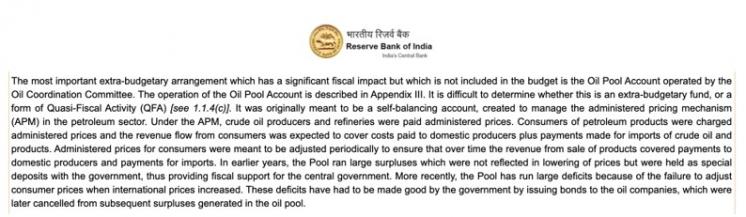

India: Transparency of quasi-fiscal activities

The central bank, the Reserve Bank of India, publishes regular reports on fiscal transparency, alongside quarterly and annual reports on quasi-fiscal activities.

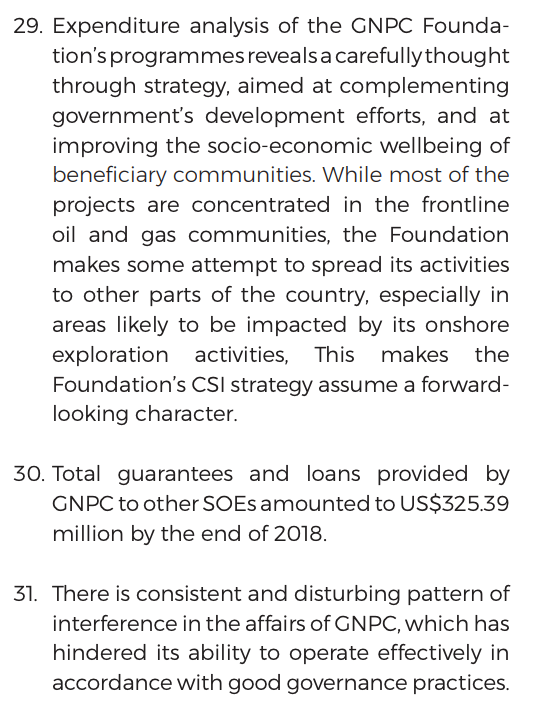

Ghana: SOE management of petroleum revenues

The statutory Public Interest & Accountability Committee publishes twice yearly reports on the management and use of petroleum revenues. These clearly highlight quasi-fiscal expenditures by the national oil company GNPC (Ghana National Petroleum Corporation).

Based on the review of systematic disclosures, the MSG should consider what additional information ot be reported and agree on reporting templates for each of the relevant entities deemed to have information related to QFEs linked to extractives revenues. The reporting templates should be tailored to each of the specific types of QFE identified and to the individual reporting entities, such as for the Ministry of Finance and specific SOEs.

The reporting templates should be designed to ensure a level of disaggregation commensurate with other payments and revenues. Requirement 4.7 of the 2019 EITI Standard requires disaggregation of data by individual project, company, government entity and revenue stream. Disclosures of QFEs should include the value of payments for each type of QFE for the year under review, disaggregated by project, company, revenue stream and receiving entity.

MSGs are encouraged to include appropriate and comprehensive guidance alongside the reporting templates when these are sent to reporting entities and organise capacity-building workshops where needed.

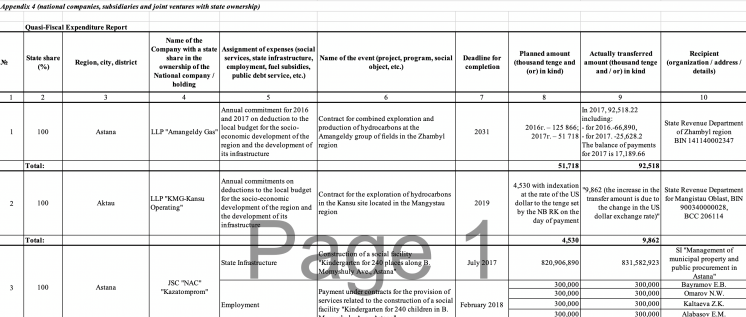

Kazakhstan: Social and quasi-fiscal expenditures

Appendix 4 of the 2017 EITI Report provides coverage of quasi-fiscal expenditures, both ad hoc and under commitments with local governments. However, there are concerns over the comprehensiveness and categorisation of disclosures.

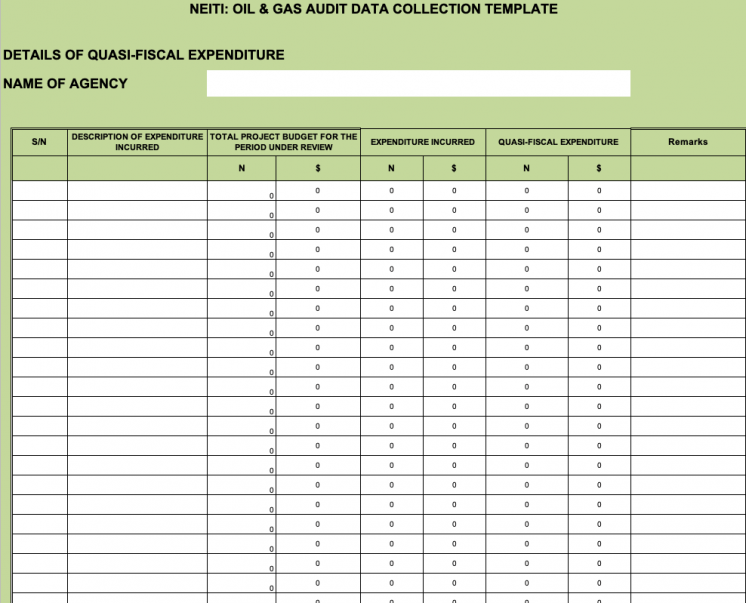

Nigeria: Data collection template

Nigeria's Nigeria’s Oil and Gas EITI reporting templates cover disclosures of the quasi-fiscal component of fuel subsidies, deducted by national oil company NNPC (Nigerian National Petroleum Corporation) to cover subsidies in excess of those covered by the national budget.

Step 5: Ensure SOEs’ and government entities’ full disclosures of quasi-fiscal expenditures

The MSG should follow up with relevant reporting entities to ensure comprehensive reporting of all quasi-fiscal expenditures. This could include undertaking capacity-building seminars with reporting entities on a needs basis. EITI reporting should include a comprehensive description of all arrangements whereby SOEs undertake quasi-fiscal expenditures. Close collaboration between the MSG and the management of SOEs is needed to ensure that a robust reporting process is designed.

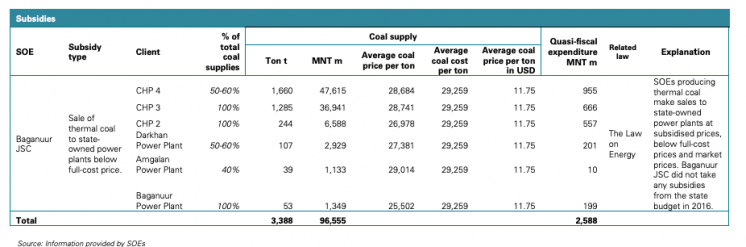

Mongolia: Quasi-fiscal coal subsidies

The 2016 EITI Report discloses the quasi-fiscal component of subsidies on thermal coal to domestic (state-owned) power plants.

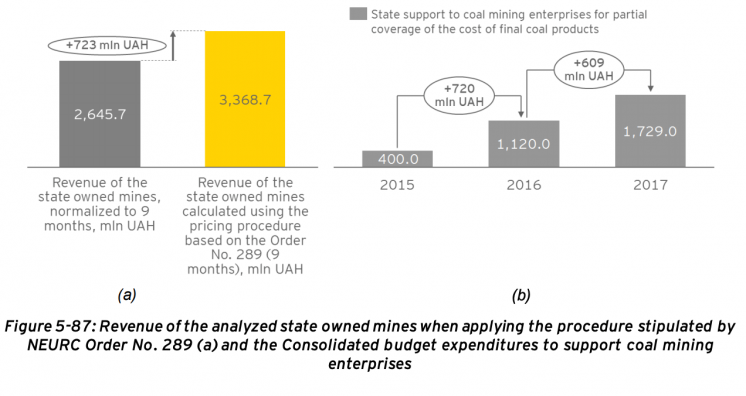

Ukraine: Quasi-fiscal coal subsidies

The 2016 EITI Report calculated the implicit subsidy by state-owned thermal coal producers to (state-owned) power plants and compared this to the government subsidy to coal producers. The figures matched, meaning there was no quasi-fiscal subsidy.

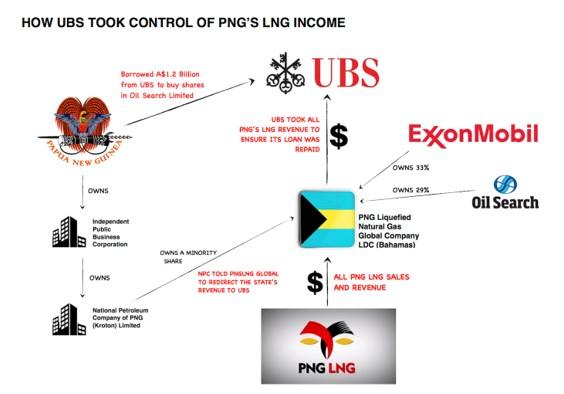

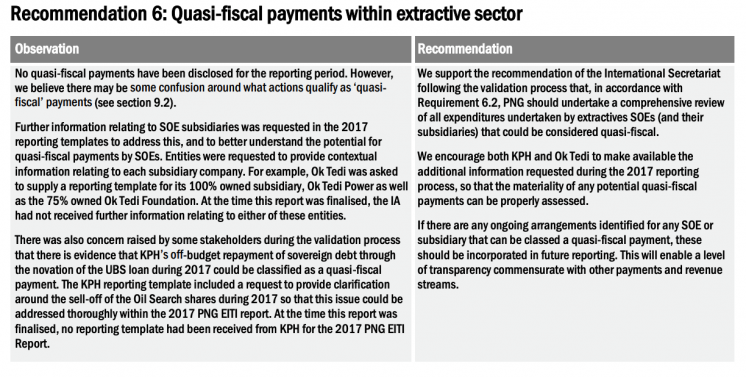

Papua New Guinea: SOE repayment of sovereign loan

While EITI reporting has yet to cover payment for national debt without it being covered in the national budget, the government transferred a USD 1bn sovereign loan to a subsidiary of its national oil company Kumul Petroleum Holdings in 2016-2017. It was repaid through withholdings of dividends from the PNG LNG project. Although SOEs did not report any quasi-fiscal expenditures, the 2017 EITI Report includes a recommendation for a comprehensive review of all SOE expenditures to identify quasi-fiscal expenditures.

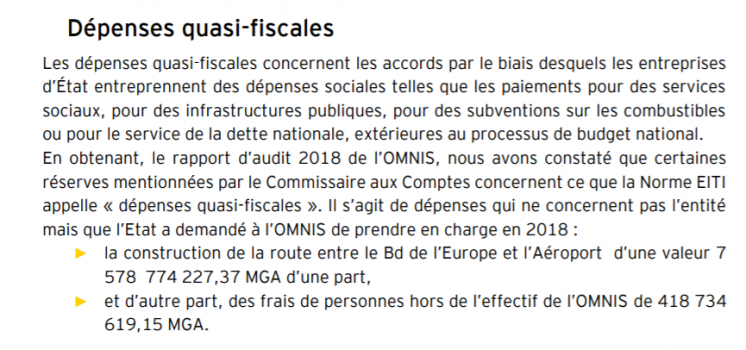

Madagascar: Quasi-fiscal spending on infrastructure and ministry expenses

EITI reporting and online disclosures by SOE OMNIS (Office des Mines Nationales et des Industries Stratégiques) provided details of payments of officials’ overseas travels and road rehabilitation undertaken by OMNIS.

Further resources

- IMF (2007), ‘Fiscal Transparency Manual 2007’

- International Budget Partnership, ‘Guide to Transparency in Public Finances: Quasi-fiscal activities’

- Natural Resource Governance Institute (2018), ‘Guide to Extractive Sector State-Owned Enterprise Disclosures’

- Transparency International (2014), ‘Public financial management topic guide'